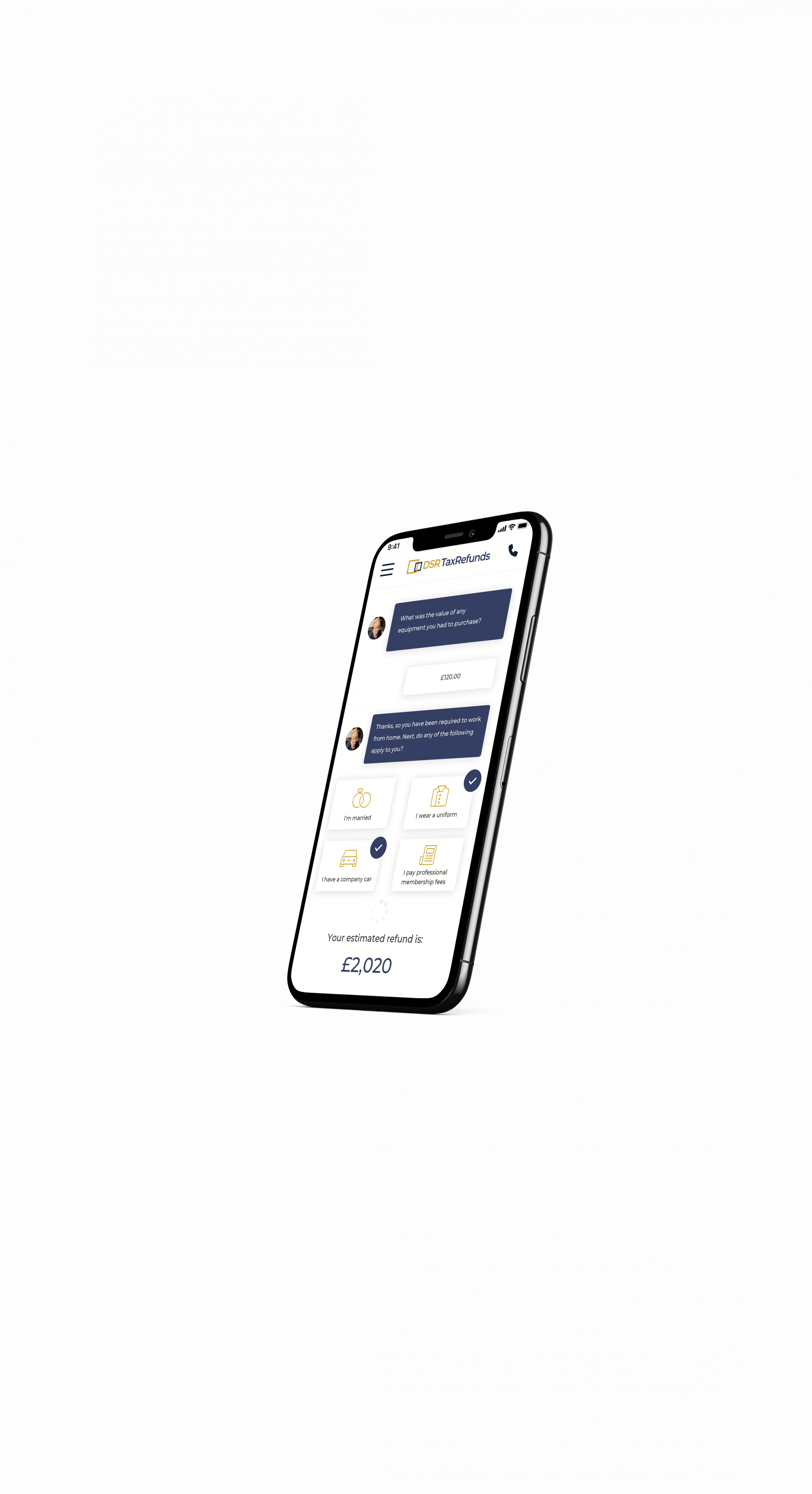

Working From Home Refunds

Working from home has become a way of life for many over this past year meaning that you pay our less on transport costs but are likely to have additional costs at home instead. Whether you have had increased energy bills or have needed to kit out a new home office, we might be able to help you claim some of those costs back.